The Enel Group's risk governance is based on a structured and formalized set of elements that are defined and updated periodically in line with the evolution of the Group's businesses, with the international risk management standard ISO: 31000 2018 and with the best risk management practices.

You are viewing the site in English. Change language or close and continue.

SPANISH

Risk Management

The Enel Group's Risk Governance model is based on two principles: the pillars of risk governance and the risk catalogue.

Pillars of Risk Governance

1.

Defense lines

The model is structured through three lines of defense for risk management, monitoring and control activities.

2.

Enel Group Risk Committee

This Committee, created at management level and chaired by the CEO of the Enel Group, is in charge of strategic guidance and supervision of risk management.

3.

Directory

Body responsible for monitoring and controlling the main risks related to the Company and its subsidiaries, including any risk that may affect sustainability in a medium or long term perspective, determining the degree of compatibility of said risks with the established strategic objectives.

4.

Risk appetite framework

It constitutes the frame of reference to determine the tolerable level of risk. Expressly formalized in the Group's risk catalogue.

5.

Risk policy

It allows developing processes for measurement, assignment of responsibilities, coordination mechanisms and the main risk control activities.

6.

Reporting system

For continuous and structured reporting to decision makers on key risk exposures globally, for each line of business or significant geographic area.

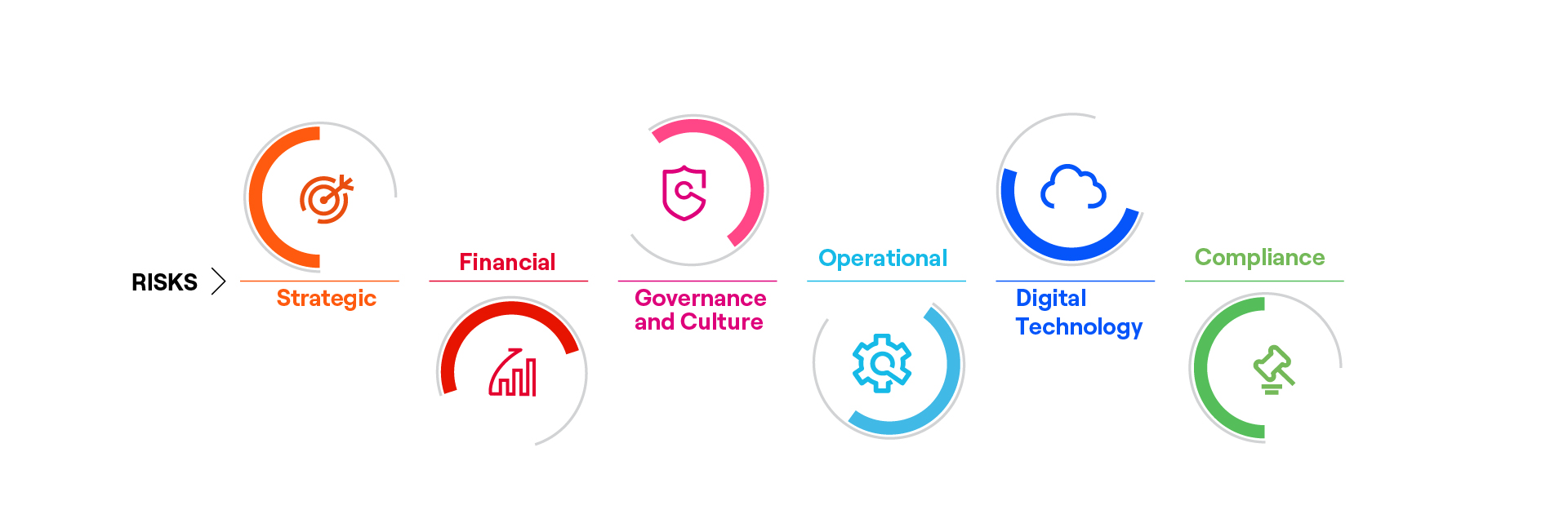

Risk catalog

The risks are defined in a risk catalog that serves as a reference for all areas involved in the risk management and monitoring processes. The adoption of a common language facilitates the mapping and comprehensive representation of risks within the Group, thus allowing the identification of those that impact the processes and organizational units involved in their management.